Most of us will know the procedure: you just arrived at the airport in a foreign country and want to stack up with cash. It’s usually no problem to find an ATM, and many travelers use a credit card without any international transaction fees. So everything should be fine, right?

Wrong! There is a trick that many ATM operators, retailers, or financial service providers use to earn some extra money with people that need to withdraw cash when they are abroad. Let’s see how getting some money at a local ATM can cost you more then you’d think.

Table of contents

A real-life example

Travel-Dealz founder Johannes visited Great Britain – more precisely London – some time ago. After arriving at the airport, his first way led him to an ATM. Since he wasn’t able to use his Euros in London, he had to get himself some Pound Sterling to have fun downtown.

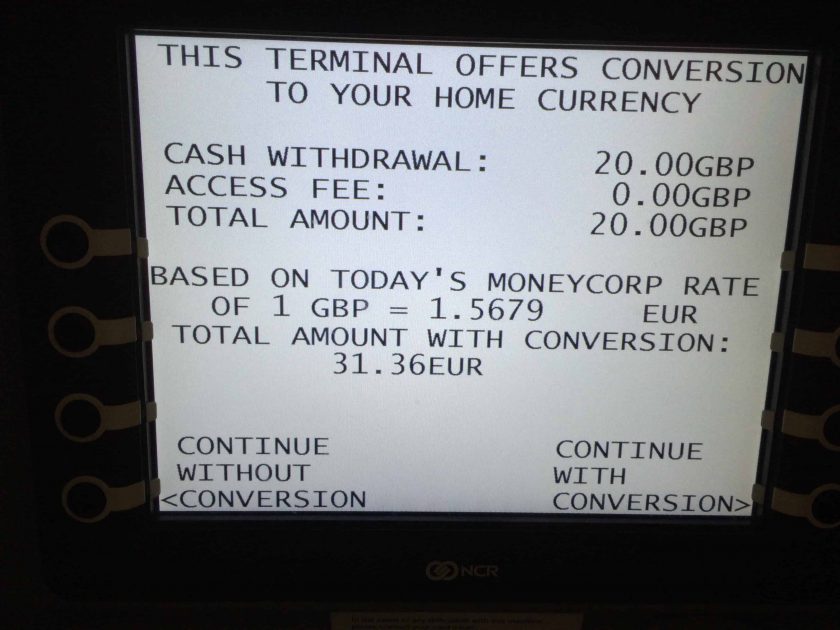

After choosing the amount he wanted to withdraw, Johannes had to answer one last question: should his account be debited in local currency or in the currency of his home country?

Given the exchange rate that the ATM suggested, which at that time was 1 GBP = € 1,5679 (if you’re from the UK you might want to turn back time now), his 20 Pound Sterling would have cost €31,36. At first sight, this doesn’t sound like the rip-off we’ve talked about in the title. After all, you can see that Moneycorp (whoever that may be) is giving you the daily exchange rate, right?

So, would you choose to Continue Without Conversion or Continue With Conversion?

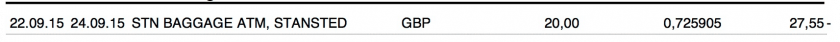

Just three letters can make all the difference! In that case, around 12%. Of course, Johannes opted to have his account debited in local currency and clicked the Without option. A great choice, since the credit card company charged €27,55 for the £20:

That equals savings of €3,80. Imagine withdrawing £500 in that same situation and letting the ATM operator convert the amount for you? This would have made a difference of close to €100! Unbelievable!

Assuming that you’re using a credit card that does not charge international service fees, withdrawing your money in your local currency won’t save you anything. But in our example, even a card with fees up to 2% would still cost you less than converting the money at the ATM.

Dynamic Currency Conversion

And now we know the name that makes that business model possible: Dynamic Currency Conversion. This “service” is offered to foreigners more and more often. ATMs will ask you to withdraw your money in your local currency. But also hotels or merchants in popular tourist destinations will play along.

And it really is a sneaky approach. Who memorizes the current exchange rate before using his credit card when getting some cash or paying for a nice meal during a vacation? You see the amount displayed in your home country’s currency. This gives you a false feeling of security. And by the time you’re account is debited, you won’t realize that you’ve paid too much.

But one man’s loss is another man’s gain. ATM operators, retailers, or financial service providers will be happy to see you paying more than you’d have to. And it’s weird. You probably wouldn’t trust some guy you just met in a restaurant to give you a reasonable exchange rate. But you do trust the waiter with his electronic credit card terminal.

Since the retailers (may it be a hotel, a restaurant, a gas station or a rental car company) get their cut, it’s no surprise that they won’t save you from making expensive mistakes. That’s why you should always check the displayed amount and never just accept the payment. It’s better to insist on paying in the local currency.

DCC When Shopping Online

You don’t have to visit foreign countries to run into companies trying to make more money by converting currency for you. In fact, you don’t even have to leave your house. Nowadays, more and more businesses are using the same model online.

Amazon

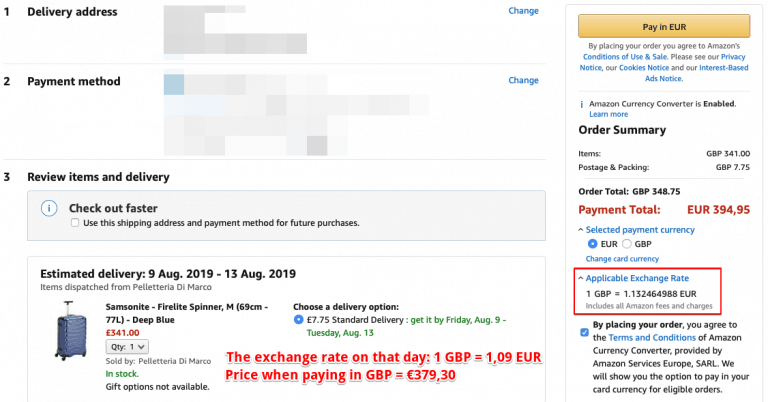

You’ve found that one great product you’ve always wanted but Amazon is not selling it in your home country. No problem. Shipping is available and so is paying in your local currency. A great deal? Of course not. Amazon will offer you a lousy exchange rate:

Ryanair

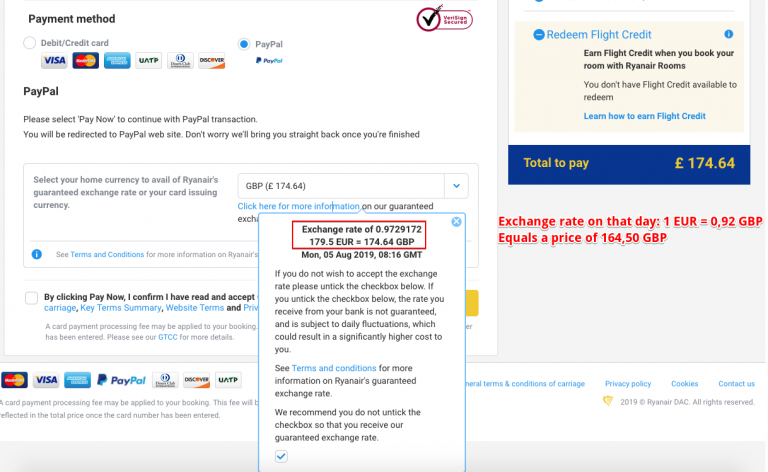

If you try to book a flight from a country that is not using your local currency, Ryanair won’t let you down. They will go out of their way to exchange your money. Again: don’t take the bait!

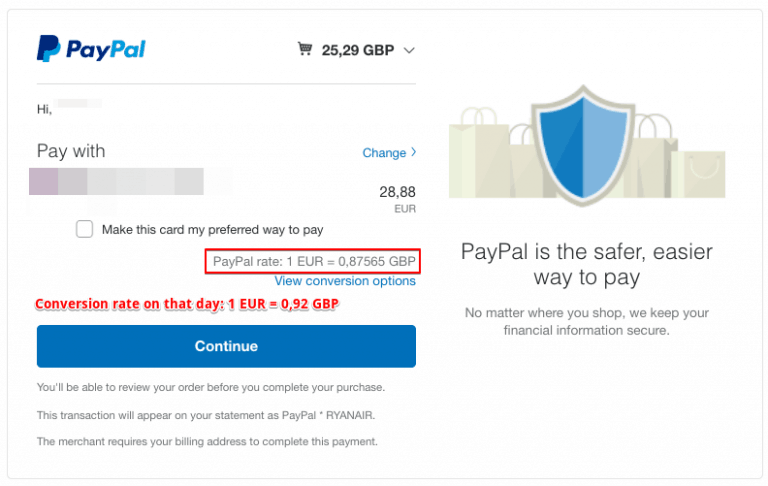

PayPal

While its name suggests that the tool is your best friend when paying for goods, the conversion rate that PayPal gives you is worse than what you’d typically get from your credit card-issuing bank. But at least there is a way to Disable PayPal’s Dynamic Currency Conversion.

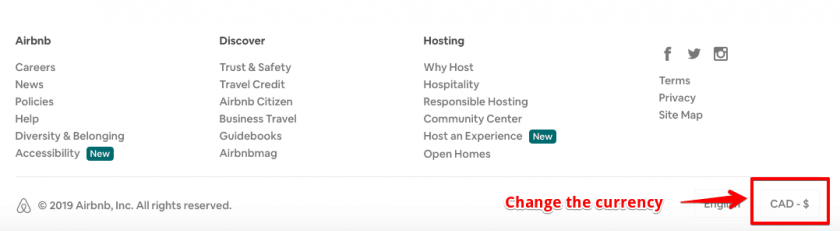

Airbnb

If you booked your stay in a foreign currency, let’s say US Dollar, Airbnb will exchange the amount to your home countries currency. There is a quick and easy sole for this: scroll down to the very bottom of the site to switch to whatever currency you want.

How can I prevent Dynamic Currency Conversion?

- Always pay in local currency. No exceptions!

An ATM will let you choose if you want to convert or not. This can get trickier when paying at a hotel or in a shop. Tell the people you’re making business with that you insist on paying in local currency. - Have a good look before signing anything or entering your code at a machine. In doubt, ask the cashier to show you how you can check in which currency you’re paying.

- If the cashier or merchant doesn’t want to comply with your request, just don’t pay or buy anything. In some cases, it might be too late already. You can still try to make a note on the receipt. Write LOCAL CURRENCY NOT OFFERED, strike out the displayed amount, and sign it afterward.

At least Visa and MasterCard are very clear about a business’ that doesn’t offer to pay in local currency: it’s a reason for a chargeback!

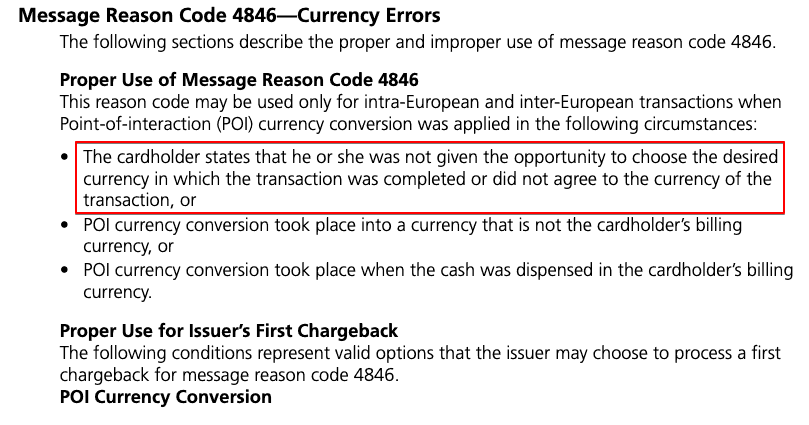

With MasterCard, you can use the code 4846 for Correct Transaction Currency Code Not Provided:

[…]

• POI currency conversion disputes in the following circumstances:

– The cardholder states that he or she was not given the opportunity to

choose the desired currency in which the transaction was completed or

did not agree to the currency of the transaction, […]

Source: MasterCard Chargeback Guide Page 304

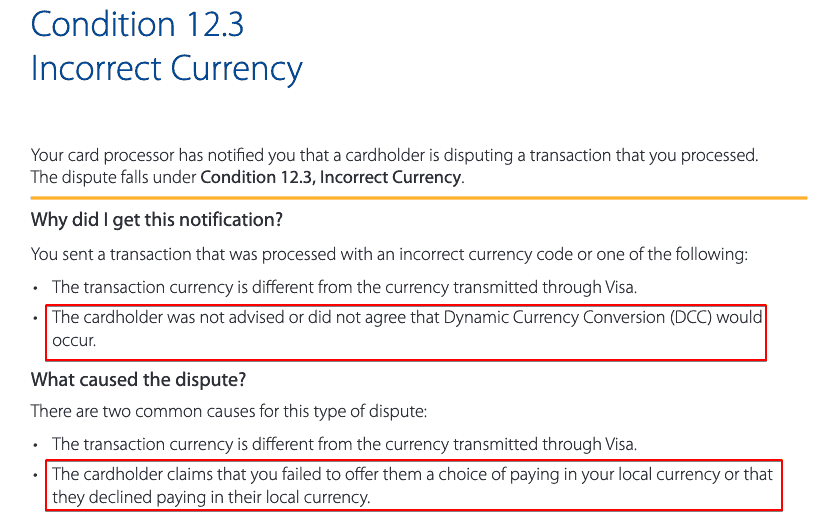

Also, Visa included the topic of incorrect currency into its guidelines: Condition 12.3 – Incorrect Currency

• Cardholder was not advised or did not agree that Dynamic Currency Conversion (DCC) would occur

• Cardholder claims that you failed to offer them a choice of paying in your local currency or that they

declined paying in their local currency

Source: Chargeback Management Guidelines for Visa Merchants Page 35

Bottom Line

It might be titled a “service”. But you will hardly ever benefit from it. Dynamic Currency Conversion is just an excellent way to hide fees by adding them to the conversion rate. And what would you call it if someone tries to make more money and offers you nothing in return? Exactly, a big rip-off!

Cover Picture: © Tabthipwatthana - Fotolia.com

Comment (1)

So, yes. In principle, the article is correct, DCC rarely saves you money. But it does at times (particularly where your card does double exchange rate, so for instance you’re an EU citizen trying to buy in GBP and your currency is not EUR but HUF, PLN, CZK, etc.. your currency would first be converted into EUR and only then in your currency). So, whatever you do, just make sure you understand what the price point is and if it edges towards your bank native cinversion, just go with it (say +/- 5%). Otherwise it’s not a bad idea to use DCC. After all, everybody is chasing after that spread, why would you give way to your bank? Just go with the winner.